Fund IV: Building on a Decade of Success

Crystal View Capital's Fund IV continues our proven strategy of investing in recession-resistant self-storage and manufactured housing communities. With a target raise of $200 million, Fund IV offers accredited investors the opportunity to participate for long-term wealth creation.

Fund Highlights

Investment Thesis

Fund IV will leverage our established networks and expertise to:

Acquire undervalued self-storage and manufactured housing assets in strategic locations. Implement our proven value-add strategies to enhance operations and increase profitability. Capitalize on the growing demand for affordable storage solutions and housing options. Generate stable cash flows with potential for significant appreciation upon exit

Long-Term Thesis

Acquisition Opportunity

Over $100 million in specific targets identified, with a focus on off-market deals from retiring "mom and pop" owners.

Demand for Affordability

Addressing the US housing affordability crisis through manufactured housing communities.

Institutional Appeal

Potential for significant portfolio aggregation and eventual sale to large institutions.

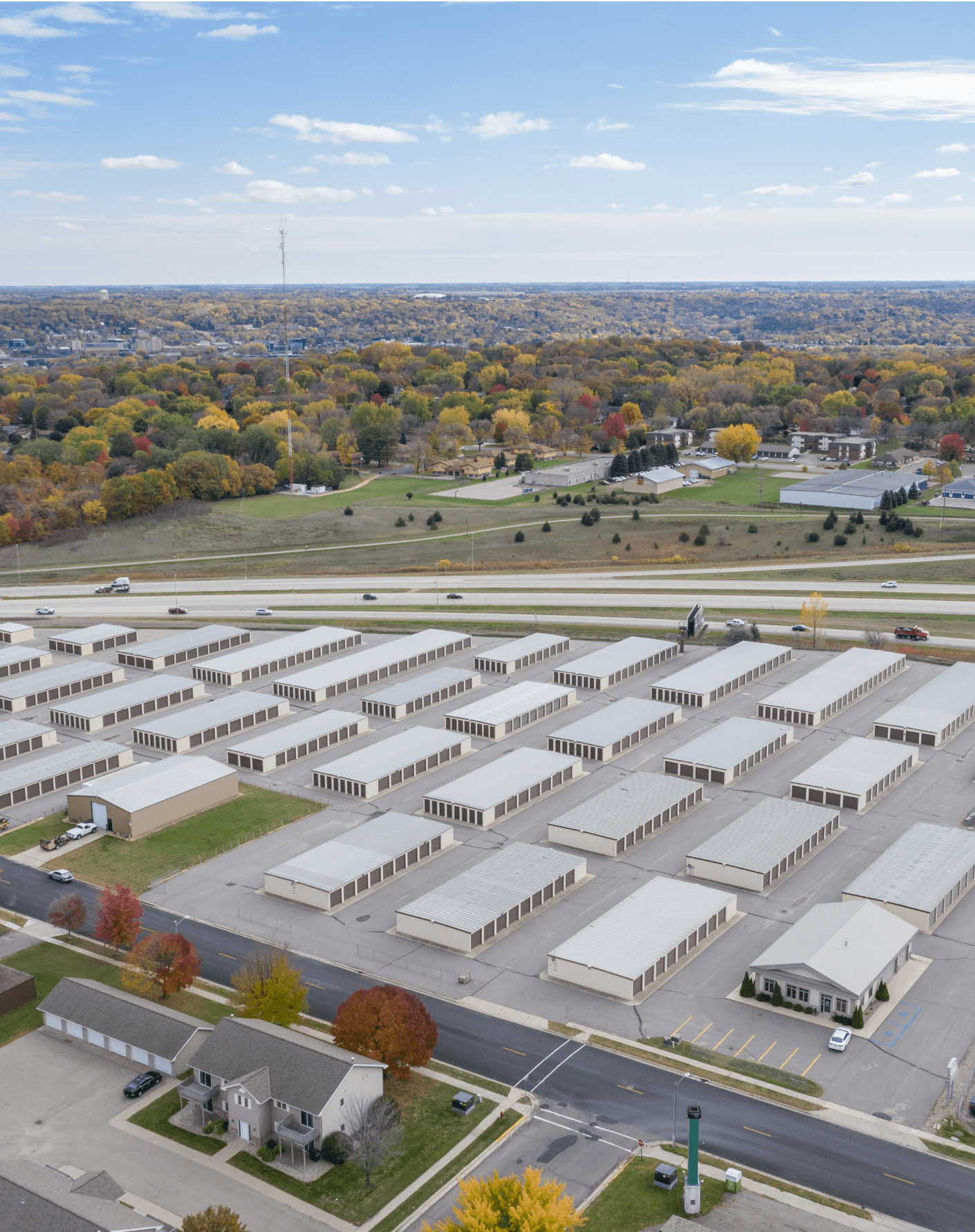

Current Fund IV Portfolio

As of August 2024, Fund IV has already acquired a strong portfolio of assets:

17

Total Assets

2,197

Storage Units (256,257 rentable sq ft)

1,086

Manufactured Housing Community Sites

$56 M

Assets Under Management

Why Invest Now?

Proven Track Record

Our previous funds have demonstrated strong performance, producing a 30% average IRR accross all funds.

Recession-Resistant Focus

Our chosen sectors have demonstrated resilience through economic cycles.

Vertical Integration

Full control from acquisition to management, ensuring operational excellence

Off-Market Advantage

92% of our deals are sourced off-market, providing unique opportunities