July 24, 2024

Crystal View Capital Fund III Refinances Tennessee Storage Portfolio with a 6.53% Fixed Interest Rate

We are pleased to announce the successful refinancing of our Tennessee storage portfolio. The original $15 million loan has been replaced with a new $23 million loan at a fixed interest rate of 6.53%. This strategic move allows us to achieve substantial savings.

This 11-site storage portfolio consists of approximately 2,500 storage and parking units. Since acquisition, we have executed on several initiatives to increase the value of the asset:

By consistently analyzing the market to optimize rents based on demand, we achieved a 15% increase in the portfolio's storage charge, generating approximately $5.9 million in value at a 6.5% cap rate.

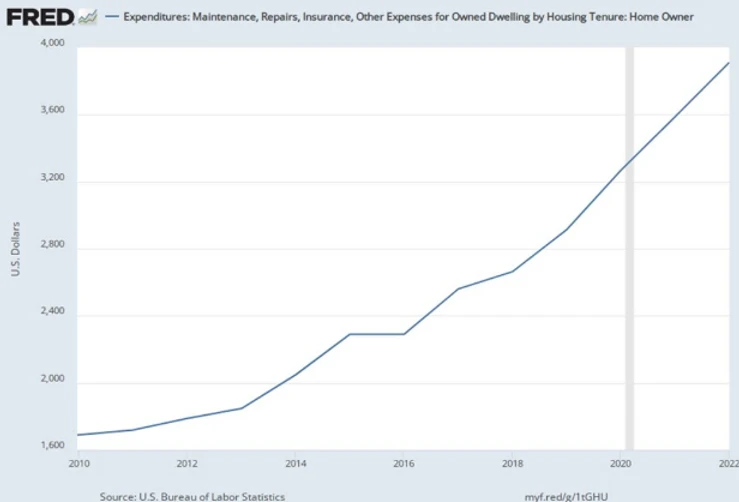

Implementing tenant insurance across our storage portfolio has generated ancillary income, resulting in an added value of approximately $3.2 million at a 6.5% cap rate.

We enhanced the overall portfolio by executing various repairs and upgrades such as new gates systems and improving the general curb appeal, which has elevated the tenant experience.

As a result of our in-house asset management team's efforts, we have achieve a 26% increase in total revenue and 9% increase in NOI.

Crystal View Capital is actively raising capital for its fourth fund, Crystal View Capital Fund IV, LP with a target raise of $200 million. Presently, Fund IV has over $20 million in assets consisting of mobile home communities and self-storage facilities in its acquisition pipeline.

For those interested in investing, reach out to our team at invest@crystalviewcapital.com. Know of someone who would like to receive these emails? Forward this message. They can subscribe here.